Crypto Marcket Insights: Dominate long positions and mitigate risks with reac

As the world of cryptocurrency continues to grow in popularity, intelligent investors recognize the importance of developing effective investment strategies. A key component of a successful long -term investment approach is risk management, which implies carefully selecting the assets that are aligned with their financial objectives and a tolerable risk level.

In this article, we will deepen two crucial aspects of cryptographic investment: build long and robust positions and implement effective risk management techniques using the Ethereum name service (Ease).

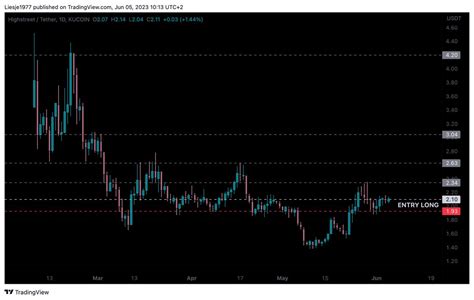

Building long robust positions

A long elaborate position is essential to navigate the ups and downs of the cryptocurrency market. By selecting assets to invest, it is essential to consider factors such as:

- Market capitalization : Invest in smaller or medium capitalization cryptocurrencies can be more volatile than the highest capitalization assets.

- Ecosystem developed : A well established network with a strong community and a robust infrastructure can reduce the risks associated with market fluctuations.

- Trend analysis : Perform an exhaustive investigation into the technical indicators of the asset, such as price patterns, volatility and correlation with other assets.

To build a long position, investors must:

- Diversify

: Disseminate investments in several cryptocurrencies to minimize exposure to any asset.

- Establish clear objectives : Define specific investment objectives, risk tolerance and deadlines to guide investment decisions.

- Monitor and adjustment : Continuously check the performance and rebalancing of the portfolio as necessary to maintain alignment with the investment objectives.

Ethereum name service (Ens): A change of game for safe identity

Ethereum Name Service (ENS) has revolutionized the way users administer their digital identities, allowing perfect interactions on different blockchain platforms. TAS allows people to create a unique and decentralized domain name that can be used to access and share content, assets or services in several networks.

BENEFITS OF USE FOR LONG POSITION MANAGEMENT

- Increased flexibility : Users can establish multiple accounts using their existing names, which facilitates the management of complex portfolios.

- Improved Security

: EES provides a layer of protection against identity theft by allowing users to safely store confidential information on different platforms.

- Improved User Experience : With ENS, users can access content, assets or services without worrying about the ownership of domain names or conflicts.

Implementation of Risk Management Techniques with ENS

To mitigate the risks associated with ENS, investors must:

- Use a risk management framework : Establish clear and threshold guidelines to guide investment decisions.

- Diversify the portfolio : diffuse investments in multiple assets and networks to reduce exposure to any asset or platform.

- Monitor performance : Continuously check the TES holdings and adjust the portfolio as necessary to maintain alignment with risk tolerance.

In conclusion, the construction of solid long positions requires careful consideration of market capitalization, developed ecosystems and trends analysis. When implementing effective risk management techniques, such as portfolio diversification and use safe identity solutions such as Ens, investors can minimize risks and maximize yields in the world of cryptocurrency investment.

Geef een reactie