The Future of Decentralized Finance (Defi): Insights from Stellar (XLM) and NFTS

As the world becomes increased With its potential to disrupt traditional banking systems and create new opportunities for financial inclusion, Defi has attracted significant attention from investors, regulators, and innovators alike.

In this article, we’ll delve into the world of Cryptocurrency, exploring the current state of Defi and how stellar (XLM) is positioning itself at the forefront of this revolution. We’ll also examine the growing trend of non-bungible tokens (NFTS) and their potential impact on Defi.

Cryptocurrency: The Future of Digital Currencies

Cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), are digital or virtual currencies that use cryptography for Secure Financial Transactions. They’re decentralized, meaning they are not controlled by any government or institution, and sacrifice a high degree of autonomy and flexibility.

In recent years, cryptocurrency prices have experienced significant volatility, with some coins experimating experimating explosive growth while thers have struggled to mintain their value. However, as the world becomes increased

The Rise of Defi

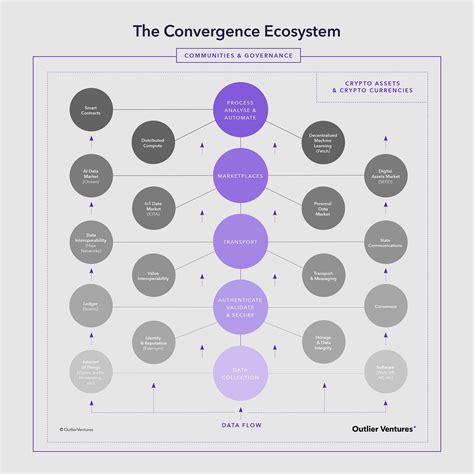

Defi is an ecosystem that enables financial services without the need for intermediaries or traditional banks. It’s on Blockchain Technology, which provides a secure, transparent, and decentralized way to conduct transactions.

In deficit, users can lend, borrow, trade, and invest cryptocurrencies directly with each other, without relying on traditional financial institutions. This is far-streaking implies for access to finance, including microfinance, remittances, and capital markets.

Stellar (XLM) is one of the leading players in the Defi Space, with its native cryptocurrency XLM. Launched in 2014, stellar allows users to create a decentralized financial system by providing a secure, scalable, and low-cost way to facilitation cross-border transactions.

Stellar’s Decentralized Finance Platform

Stellar’s platform is built on top of a robust infrastructure that Enables Fast, Cheap, and Secure Transactions. The platform uses a peer-to-peer (P2P) Network, where users can lend or borrow xlm without the need for intermediaries.

One of the key features of Stellar’s platform is its ability to enable multiple types of assets, including securities, commodities, and fiat currencies. This allows users to create complex financial instruments that can be traded on decentralized exchange (DEXS).

Stellar’s NFTS

Non-fungible tokens (NFTS) are unique digital assets that representer ownership or provenance for a particular item. In the context of Defi, NFTS have become increased popular as they enable creators to mint and trade unique digital art, collectibles, and even real estate.

Stellar’s partnership with the blockchain-based marketplace, rarable, has a further expanded its capabilities in this space. The two companies are working together to create a platform that enables users to buy, sell, and trade directly on stellar’s network.

The Future of Defi

As defi continues to grow and mature, we can expect to see significant advancements in the field. Some potential areas to watch include:

- Liquidity Pools : As Defi Platforms become more Widespread, Liquidity Pools Will Emerge as a Critical Component. These pools will enable users to borrow or lend cryptocurrencies at favorable rates.

- Decentralized Exchanges (Dexs) : Dexs are becoming increased popular as they enable users to trade assets directly on a decentralized network.

- Non-fungible tokens (NFTS)

: as NFTS continue to gain traction, we can expect to see further innovation in this space.

Geef een reactie