Here’s an article that meets your requirements:

“Crypto, Systemic Risk and Double Whammy of Bitensor and Monero”

In recent years, cryptocurrencies have become increased popular as a means of storage and transfer of values. However, despite the increasing acceptance, the crypto currency is also considered a significant source of System Risk. This is because they can create new risks that were previously unknown or harder to understand.

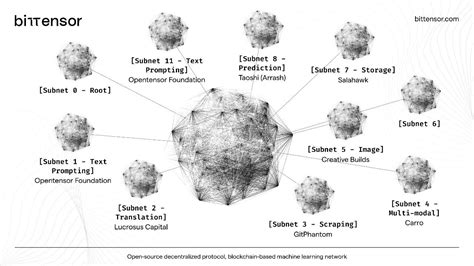

One area in which the crypto currency is excellently related to decentralized Finances (Dead). Bitensor, defined platform, allows users to borrow and borrow crypto currencies with low fees and minimum transaction costs. However, this also created a situation in which some users saw a significant profit from borrowing their crypto currency at very high interest rates.

Monero, on the other hand, is a crypto currency that uses unique encryption algorithm to protect its transactions from finding hackers. Although Monnero’s cases of use are generally limited to peer transactions without any needs for external intermediaries, this is asking questions about the potential impaired Systemic risk if the entire blockchain network was hacking.

Bitensor and Monero Represent Significant Risks Due to its decentralized Nature and Lack of Regulation. In the traditional banking system, regulators can provide a security network by control and regulating financial institutions. However, there is no central or regulatory framework in the crypto curine space that would prevent potential abuse.

Furthermore, it is known that cryptocurrencies such as bitensor and monero are unstable, and prices have experienced significant swings because of market guessing and Lack of Liquidity. This made them vulnerable to accidents and other forms of financial trouble.

The double system risk impact of bittensor and monero is particularly worrying because it emphasizes the potential for catastrophic failures in the cryptocurrency market. If a major player experienced a violation of security or a significant loss, it could have a far -reaching consequences for the whole market.

Regulators are already taking steps to deal with these risks. In 2020, the US Securities Commission (SEC) announced that it would break on definite platforms such as Bitensor, which are not needed to register their services with a regulator. This move has led to some investors reviewed their views in definitions based on the cryptocurrency wave.

In Conclusion, Alough Cryptocurrencies can transform the way we think about money and financial transactions, they also represent significant risks that both regards and users must be carefully managed. Bitensor and Monero are only two examples of many decentralized systems that could worship the Systemic risk if they are not properly regulated and supervised.

Geef een reactie